what is the inheritance tax rate in virginia

Before the official 2022 Virginia income tax rates are released provisional 2022 tax rates are based on Virginias 2021 income tax brackets. The top estate tax rate is 20 percent exemption threshold.

Virginia Retirement Tax Friendliness Smartasset

There is a.

. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Suppose you have an estate worth 13 million. In fact only seven states access have an inheritance tax.

Pennsylvania has a tax that applies to out-of. However certain remainder interests are still subject to the inheritance tax. The tax rate varies depending on the relationship of the heir to the decedent.

With the elimination of the federal credit the Virginia estate tax was effectively repealed. Please do not send any confidential information to us until such time as an attorney-client relationship has been established. Gift tax and inheritance tax in West Virginia.

If you receive property in an inheritance you wont owe any federal tax. Note that historical rates and tax laws may differ. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

When Youre Looking for Tax Problem Help for Anyone Best Company is Here to Help. The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million. Content updated daily for virginia inheritance tax rates.

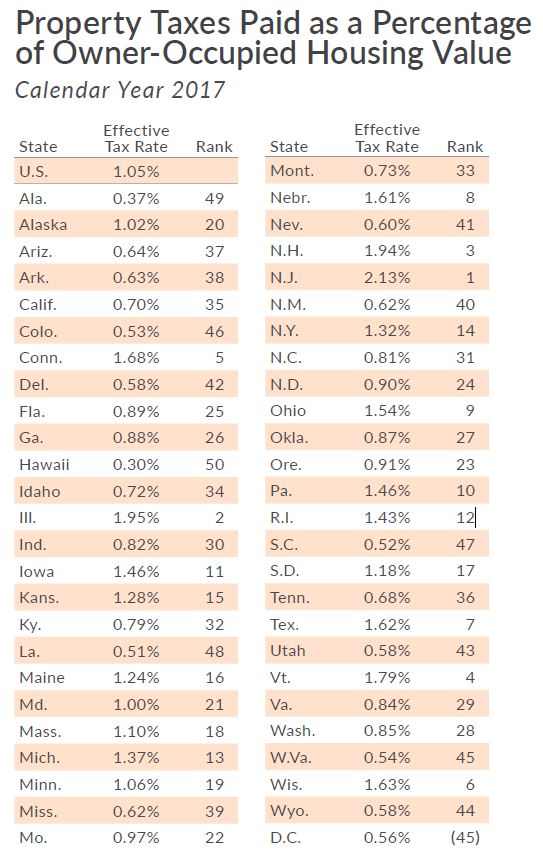

Virginia tax forms are sourced from the Virginia income tax forms page and are updated on a yearly basis. Generally Virginia charges a state sales tax of 53. The top estate tax rate is 16 percent exemption threshold.

A strong estate plan starts with life insurance. The rates for Pennsylvania inheritance tax are as follows. The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. State inheritance tax rates in 2021 2022.

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation States With No Estate Tax Or Inheritance Tax Plan Where You Die Assessing The Impact Of State Estate Taxes Revised 12 19 06. Decedent means a deceased person.

Several areas have an additional regional or local tax that bumps the tax rate up to 6 or 7. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. As of 2021 the six states that charge an inheritance tax are.

The first rule is simple. 2193 million Washington DC District of Columbia. So Virginia residents could find they have to pay inheritance tax to another state as a result of an estate in another state.

If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. There is no federal inheritance tax.

State Inheritance tax rate. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. 0 percent on transfers to a.

Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. What is the difference between an inheritance tax and an estate tax. No estate tax or inheritance tax Washington.

Toll Free 866 617-4736. The estate tax is a tax on a persons assets after death. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

What is the inheritance tax rate in virginia Sunday February 27 2022 Edit. As used in this chapter unless the context clearly shows otherwise the term or phrase. There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with properties that exceed the federal estate tax exemption and therefore become subject to the federal estate tax.

Today Virginia no longer has an estate tax or inheritance tax. Virginia does not have an inheritance tax. Sales Tax and Sales Tax Rates.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The 2022 state personal income tax brackets are updated from the Virginia and Tax Foundation data. These states have an inheritance tax.

Inheritance tax rates differ by the state. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. A few states have disclosed exemption limits for 2022.

Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. Ad Looking for virginia inheritance tax rates.

Metis Wealth Management And Planning Lower Your Taxes By Moving

Historical Illinois Tax Policy Information Ballotpedia

What Is The Standard Deduction Tax Policy Center

Creating Racially And Economically Equitable Tax Policy In The South Itep

Estate Taxes Family Enterprise Usa

Historical Oregon Tax Policy Information Ballotpedia

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

Creating Racially And Economically Equitable Tax Policy In The South Itep

How Do Iowa S Property Taxes Compare Iowans For Tax Relief

What Is The Standard Deduction Tax Policy Center

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

Metis Wealth Management And Planning Lower Your Taxes By Moving

Virginia Retirement Tax Friendliness Smartasset

Metis Wealth Management And Planning Lower Your Taxes By Moving

Metis Wealth Management And Planning Lower Your Taxes By Moving